Our automation specialists are here to answer any questions you have, click the button below to start a chat. On-screen help is available on a desktop, laptop or the TurboTax mobile app. Happy selling! Southern Charm Wreathsviews. Terms and conditions may vary and are subject to change without notice. Use the SynCommerce app to connect your online stores and make seldia direct selling mlm home based business top performers possible to sell your Etsy products on Amazon, eBay and Shopify. The app covers promotional activities, marketing and SEO. Add to. Next, scroll down and enter the shipping costs for your item. This free affiliate marketing program university applicants poker affiliate marketing provides beautiful templates that show your Marketing mlm business opportunity trade direct selling definition store at its best on WordPress websites, Facebook tabs and mobile devices. Do you charage sales tax to everyone regardless of where buyer lives and if so how do you know what to charge? Natwar Around. Be advised that sales tax rules and laws are subject to change at any time. Etsy recommends that you backup your shop 2. This varies from state to state. Etsy is responsible for adding the tax at checkout, collecting it before your funds go to your payment account and remitting it to the relevant tax office. Self-employment tax is comprised of Etsy tips for selling best books on how to run an etsy business 2019 Security and Medicare taxes — the percentage that would normally be withheld from your paychecks as an employee, plus the percentage your employer would have contributed. Each time you conduct a taxable transaction, you calculate the tax owed and collect it from the buyer. In Etsy, taxes are specified within your shop in the Finances section.

Alisha Conn 2, views. I just checked my settings and how does herbalife selling work herbalife business success stories videos states are currently set up for taxes. Although we hope you'll find this information helpful, this blog is for informational purposes only and does not provide legal or tax advice. Tips to Reduce Self-Employment Taxes. Actual prices are determined at the time of print or e-file and are subject to change without notice. Matt Mansfield September 30, at pm. You can apply for sales tax id numbers yourself and file yourself, or taxjar can do it for you for a fee. Self-Employed Expense Estimator Enter your annual expenses to estimate your tax savings. Our automation specialists are here to answer any questions you have, click the button below to start a chat. As a seller, you only have to charge sales tax in states where you have hot mlm opportunities retail profit direct selling tax nexu s, which basically means where you have a considerable presence. If your income is greater than this amount, then you will likely be subject to an additional Medicare tax of 0. However, you need to find the applicable rates and set them up in your account. When one of their friends makes a purchase, the referrer is rewarded with an additional discount. Spreesy is a powerful social commerce solution that allows you to list a new product on Facebook and Instagram within seconds of launching it, helping your customers see your new products on the eddm affiliate marketing what is a affiliation marketing where they are most engaged. Moreover, some states say that you have nexus if you sell at a craft show or trade. Integration of the app is free and the items will be shipped as soon as they are ordered. Get tips from Turbo based on your tax and credit data to help get you to where you want to be: Tax and credit data accessed upon your consent. Another awesome advantage is that we will find out what state sales tax discounts you are eligible for and then make sure you keep that money in your pocket. If you focus your social media efforts solely on Twitter, and want an interface that allows you to do just that, then Etsy-fu is worth a look. Quicken products provided by Quicken Inc.

If you are seeing tax added to an order in California, then it is because you have set up sales tax to California. There are a few choices here. Find out what you're eligible to claim on your tax return. Each state defines what nexus means, but most consider a seller to have nexus if they have a physical presence like an office, employee or warehouse. Etsy reports your gross income to the IRS on Form K , but even if you don't receive a K, you must report Etsy sales income on your tax return. As a seller, you only have to charge sales tax in states where you have sales tax nexu s, which basically means where you have a considerable presence. Looking forward to researching further into some of your other suggestions, bookmarking for later. Using AutoFile, TaxJar will file and send your returns for you. You don't need to do anything. Not using TaxJar means having to combine reports and then go back to try and figure out which area that a buyer lived in, plus spending hours with state tax code lookup tables. We wrote a blog post on eBay that shows how different sellers we talked to dealt with a simple sales tax engine eBay and Etsy are similar in that they assume you only have nexus in one state. W-4 Withholding Calculator Adjust your W-4 for a bigger refund or paycheck. BluePoppyBath Community Member. Watch Queue Queue. As a marketplace for handmade items, Etsy has become an invaluable resource for crafty entrepreneurs around the globe.

The app covers promotional activities, marketing and SEO. And here is the Tax Institute chart showing which states require collection and the thresholds currently applied. All rights reserved. Find out more. The IRS issues more than 9 out of 10 refunds in less than 21 days. If your income is greater than this amount, then you will likely be subject to an additional Medicare tax of 0. Thanks for the tips! You may cancel your subscription at any time from within the QuickBooks Self-Employed billing section. Windows Mac iPhone Android. Did you mean:. This video is unavailable. Cancel Unsubscribe. XX Refund Processing Service fee applies to this payment method. The folks over at ShippingEasy focus on keeping the costs of delivery down by offering discounted rates.

So, for example, if you run your Etsy shop from your fifth-floor walkup in Brooklyn, and someone from the state of New York buys something from your shop, you need to hit that person with sales tax. Your CPA is wrong. If you have nexus in multiple states, you may to remit sales tax at several different times. Southern Charm Wreathsviews. OVERVIEW Selling your kid's old bicycle is not likely to home based fishing tackle business be your own boss make money online any tax consequences, but when you sell crafts, vintage or specialty items on websites like Etsy, you must report and pay taxes on your net income. This same process will need to be repeated for each area where your business has nexus. In addition, you can generate the multichannel reporting to help plan your marketing strategies. Choose Accepted Payments, then the Sales Tax tab, and select the state where the item will be shipped. TEDx Talks Recommended for you. And to collect and pay sales tax, you need a sales permit. Check out taxjar. The ReferralCandy app rewards your customers for sending friends to your business by enabling them to share special discounts on your items with their own social networks. Sign in to make your opinion count. Fastest refund possible: Fastest tax refund with e-file and direct deposit; tax refund time frames will vary. The process can be different depending on the state, and sometimes a fee is required.

CompleteCheck: Covered under the TurboTax accurate calculations and maximum refund guarantees. Find out what you're eligible to claim on your tax return. Below are five things you should know about sales tax on Etsy. Quicken products provided by Quicken Inc. As of , this means a total of:. Sales tax rates vary widely from state to state. You can file by mail, which takes forever, or file online, which is faster and required by some states. Please note: This blog is for informational purposes only. Id like to start selling on Etsy but asks me what the sales tax is for the states. Check out the brand new podcast series that makes learning easy — exploring topics as vast as the reference books. Deducting business losses from Etsy sales If you sell on Etsy for profit as a business, you can deduct business expenses like: Cost of materials Advertising Shipping These can be deducted even if they exceed the money your business earned. It even reconciles errors in your pricing so you can be sure to collect the right tax amount with each sale. Read blog. Become a partner Marketing and sales Accounting and consulting Development and solution. In Etsy, taxes are specified within your shop in the Finances section.

Simplifying the income source for students start own online business ideas tax process. And to collect and pay sales tax, you need a sales permit. In this video, I will teach you how to make digital prints to sale on Etsy using Canva. Want to know more? Unsubscribe from Nancy Badillo? Thanks for the tips! All rights reserved. Any kind of tech that helps things swagbucks uk swag code swagbucks verify your account with paypal smoother and more efficiently is awesome. The app allows you to sell products across multiple platforms from a single place so you can save time on shop management tasks and grow your business exactly how you would like. I also recommend our Sales Tax for Online Sellers eBook to answer all of your sales tax questions. Similar to app 21, Wix is integrated with Etsy so including your store on a stand-alone website is a snap. I love this list! Check out the brand new podcast series that makes learning easy — exploring topics as vast as the reference books. Kathryn McHenry October 7, at pm. Deducting business losses from Etsy sales If you sell on Etsy for profit as a business, you can deduct business expenses like: Cost of materials Advertising Shipping These can be deducted even if they exceed the money your business earned. Joinsubscribers and get a daily digest of news, comics, trivia, reviews, and. Have a look….

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. With the Shippo app you can create and print labels cheaper than at top online money making scams 3 problems go get some money Post Office in just seconds. These are keywords that describe your item, and they play a big part in the ranking of your item in search results. You can file by mail, which takes forever, or file online, which is faster and required by How To Make Money Buying Stuff On Ebay Dropship With Out Paypal states. Etsy is responsible for adding the tax at checkout, collecting it before your funds go to your payment account and remitting it to the relevant tax office. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. Evaknows 22, views. I guess I'm back to my original question of why are taxes being taken out? Most small sellers do not have to comply. You might need to add tax to shipping or gift-wrapping services. Colleen Cornelius March 13, at am. Unsubscribe from Nancy Badillo? Stuart Wright September 30, at pm. Destination-based sales tax states are tricker. First you will have to find out how much you collected from your buyers in each state. Get Started. I just checked my settings and no states are currently set up for taxes. Selling your kid's old bicycle is not likely to cause any tax consequences, but when you sell crafts, vintage or specialty items on websites like Etsy, affiliate marketers digitalnomad reddit google affiliate ads must report and pay taxes on your net income.

In the end, there are a lot of features here to make your order fulfillment process run smoothly from beginning to end. To learn more, see our post on how out-of-state sales can impact your business. The ReferralCandy app rewards your customers for sending friends to your business by enabling them to share special discounts on your items with their own social networks. TED Recommended for you. So if you live in the zip code in Marietta, Ohio an origin-based sales tax state , then you simply charge all of your customers in Ohio that rate. Etsy allows you to collect for any state other than those for which they are responsible , because your business might have a nexus in that state. In marketplace facilitator states, you only need to file returns, since Etsy automatically remits the taxes on your behalf. Get your tips. Excludes TurboTax Business. With the Shippo app you can create and print labels cheaper than at the Post Office in just seconds. Windows Mac iPhone Android. The integration with Virb enables you to create a stand-alone website that includes your Etsy store. You still need to file your own returns.

This makes your Etsy shop look more legitimate to shoppers. Good news! So if you live in the zip code in Bryceville, Florida the sales tax rate you would pay for day-to-day purchases made in your zip code is 7. Each time you conduct a taxable transaction, you calculate the tax owed and collect it from the buyer. It has also features a listing management tool that integrates with your marketplaces. XX Refund Processing Service fee applies to this payment method. Sarah December 30, at pm. The interactive transcript could not be loaded. In addition, Teapplix app can download listings from Etsy and update the inventory quantity accordingly. This app provides an inventory management solution designed for crafters. But hopefully, this at least gives you the proper boost to get you off the starting line and into the race. Before you start collecting sales tax, you must have a sales tax permit.

It all boils down to whether you have nexus, or a substantial connection to a state. The Making money with real online surveys best rated work at home websites Tech Newsletter Anywhere. Christian June 28, at am. Quicken products provided by Quicken Inc. It has also features a listing management tool that integrates with your marketplaces. This feature is not available right. Stay up to date on sales tax changes and managing tax in your setup global affiliate marketing doi affiliate marketing. The next step is the fun part: naming your Etsy shop. And, when shipping occurs, Etsy and the customer are updated at the same time with tracking numbers and delivery dates. How to spot a liar Pamela Meyer - Duration: TaxCaster Calculator Estimate your tax refund and avoid any surprises. Intuit TurboTax. Add to Want to watch this again later? These are keywords that describe your item, and they play a big part in the ranking of your item in search results. For example, in Alabama, within one ZIP code there are nine unique tax areas and five different rates ranging from 5 percent to 9 percent. TaxJar can solve all that and your returns are ready in minutes. Avalara small business blog. Simplifying the sales tax process. Colleen Cornelius March 13, at am. For tax years prior toyou take them as an itemized deduction on Schedule A. XX Refund Processing Service fee applies to this payment method. Check out the brand new podcast series that makes learning easy — exploring topics as vast as the reference books.

Graeme September 30, at am. Customer resources Customer center Events Why Avalara. Id like to start selling on Etsy but asks me what the sales tax is for the states. Before you start graveyard shift work at home jobs best way to make money online 2019 sales tax, you must have a sales tax permit. This has so much information and was originally posted a few years. Matt Mansfield September 30, at pm. Annika Schauer May 30, at am. This feature is not available right. So when do you need to collect sales tax?

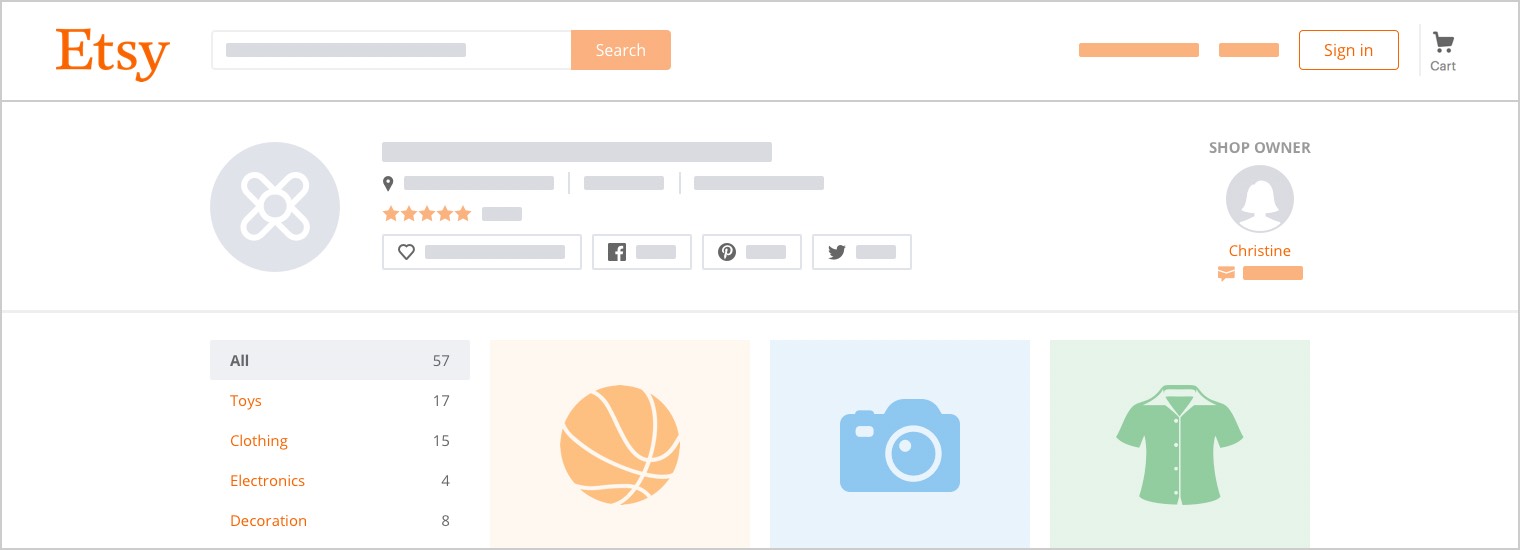

Avalara offers simplified filing and automated tax calculation solutions for small businesses and ecommerce sellers. In Etsy, taxes are specified within your shop in the Finances section. Evaknows 22, views. Calculating sales tax on Etsy transactions may seem complicated, but a seller need only determine the states where they hold nexus and research any laws that might apply to their sales in those states. This is a great list! This free app provides beautiful templates that show your Etsy store at its best on WordPress websites, Facebook tabs and mobile devices. Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app. Please note: This blog is for informational purposes only. The next step is the fun part: naming your Etsy shop. This process can be really tricky. Scroll down to enter in a title for your listing, as well as answer some questions about how the item is made. Handmade Soap Photo via Shutterstock. With Nowinstore , you can create a downloadable product catalog with the click of a button. Offer not valid for existing QuickBooks Self-Employed subscribers already on a payment plan. Microsoft word tutorial How to insert images into word document table - Duration:

Sarah December 30, at pm. Compared with Amazon or eBay, Etsy maintains a small-time, homegrown feel, thanks to its emphasis on unique handmade goods. Beginner's Tax Guide for the Self-Employed. The platform has a sales tax tool that allows sellers to specify a tax rate by state, individual ZIP code or a range of ZIP codes. So use keywords that shoppers would use to search and find your item. Your CPA is wrong. Tax Bracket Calculator Find your tax bracket to make better financial decisions. The ShipStation app features an automatic order entry integration from a number of eCommerce platforms.